Three years ago the government changed these rules for the public sector shifting the onus to the end user client. They will now be extending this change to the private sector as from 6 April 2020.

Great news!

Or is it?

Well that depends on your perspective.

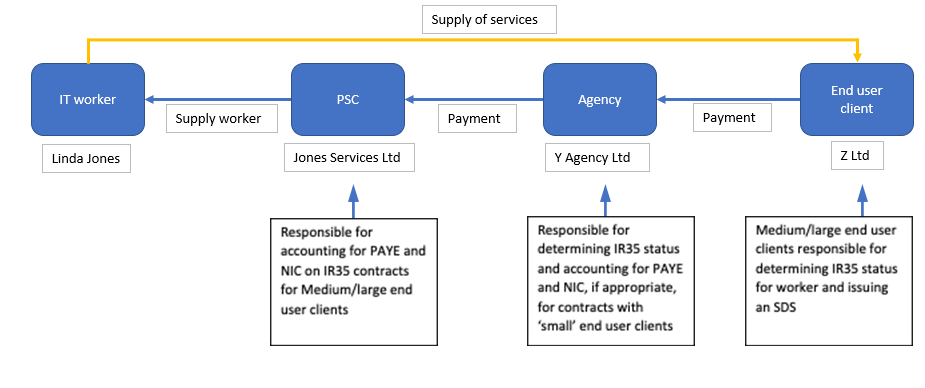

If the end user client determines that the worker/contractor falls within the IR35 rules, the responsibility for calculating and deducting income tax and NIC will fall on the fee payer, who may be another organisation altogether if, for example, the services are provided through a recruitment agency.

These new rules will also only apply to medium or large businesses in the private sector that engage workers operating through an intermediary e.g. their own company, partnership, LLP, managed service company or even an individual.

Small business exemption

So, who is exempt from this rule change?

Small end user companies as defined in Companies Act 2006 (CA 2006) for incorporated businesses will not be affected by this change.

So, to be exempt from the rules, the company must meet at least two of the following requirements:

- annual turnover of not more than £10.2m;

- balance sheet total of not more than £5.1m;

- average number of employees no more than 50.

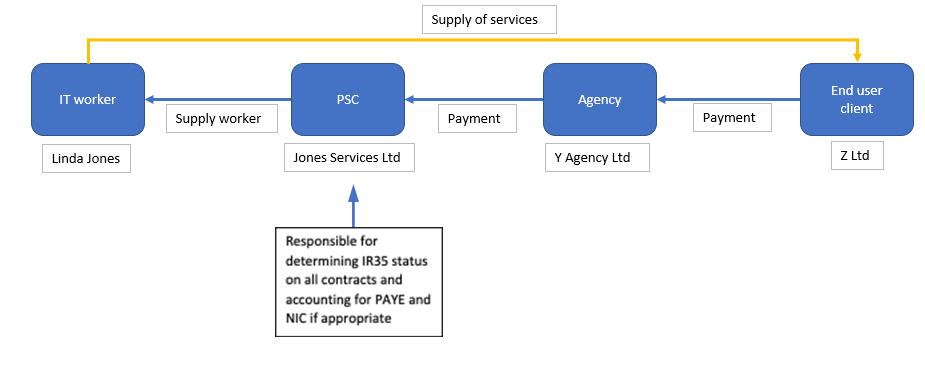

Contractors for small end users will continue to be responsible for determining whether IR35 applies and account for tax and NIC accordingly.

To determine if these rules apply to you, you will need to look at the financial period ending in the previous tax year.

For companies and LLPs this will be the period ended before 6 April 2020 for the 2020/21 tax year.

End user client and the fee payer

As the term suggests, the end user client (end user) is the organisation that is ultimately receiving the worker’s services. They will be responsible for determining whether the worker would have been regarded as an employee if they were engaged directly.

If the end user determines the IR35 rules apply, the business that is paying the worker or their intermediary (the fee payer) will be treated as the employer for purposes of PAYE and NICs.

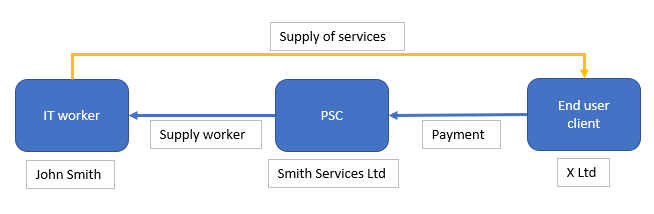

For example, where a worker, John Smith, supplies IT services to X Ltd through his PSC, Smith Services Ltd.

As the organisation receiving John’s IT services and paying his PSC, X Ltd is both the end user and the fee payer. As such it will be responsible for reviewing John’s engagement status and determining whether he falls within the IR35 rules. If X Ltd decides the IR35 rules apply it will be liable, as the fee payer, for deducting income tax and NICs from the payments made to Smith Services Ltd. It will also be liable for secondary Class 1 NICs and remitting payments and information under real time information to HMRC.

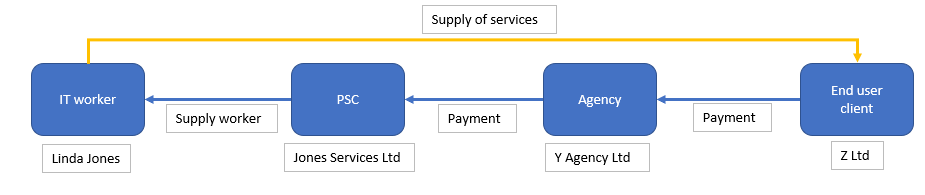

Things get a bit more complicated where the worker is engaged through an agency. In this instance, the responsibility to determine the status of the worker’s engagement would still be with the end user, the obligation to deduct PAYE and NICs would fall on the agency or the organisation making the payment to the PSC.

For example, where a worker supplies IT services to Z Ltd through their PSC.

Z Ltd is the end user but makes payment to the agency Y Agency Ltd. Z Ltd is therefore responsible for assessing if the IR35 rules apply and determining the worker’s status.

If Z Ltd decides the IR35 rules apply, Y Agency Ltd, as the fee payer, is responsible for making the income tax and NIC deductions.

So, in summary IR35 rules are changing from

To…

Getting the processes right

Not having the right processes in place to deal with the determining the status of workers could have big consequences for the end user. They include, but are not limited to:

-

- Applying reasonable care in reaching a determination and not using ‘blanket’ determinations. If reasonable care is not taken, the status determination is not valid, and the end user will become responsible for PAYE and NICS even if they are not the fee payer.

-

- Ensuring appropriate processes are in place to make and pass a status determination statement (SDS) to both the worker and the fee payer. If this is not done then, once again, the end user will take on the responsibility to operate PAYE and NICs

- A status determination disagreement process. If the worker or the fee payer make representations to the end user that the status determination statement is incorrect, the end user will be required review the determination and inform the worker or fee payer of the outcome within 45 days of receipt. If this deadline is not met, they will be treated as the fee payer and will be responsible for any PAYE and NICs due.

How will HMRC help?

HMRC has stated it will set out in guidance how a client can fulfil its obligation to take reasonable care and how it might implement the status disagreement process.

They also have an online employment status tool, Check Employment Status for Tax (CEST) to help determine whether a worker should be classed as employed or self-employed.

However, this tool does not currently consider all the factors relevant to a worker’s status and so it should not be solely relied upon to reach a conclusion. HMRC are currently working on an improved version.

Transfer of employment tax liability provisions

The draft legislation allows HMRC to recover tax liabilities from another relevant party involved in the payment to a PSC. This will allow HMRC to recover tax from the highest party in the labour supply chain, if there is non-compliance further down the chain and it is not possible for HMRC to collect the amounts due from the party liable.

It is, therefore, important to make sure that you understand who the parties in the labour supply chain are and ensure that parties further down the chain are aware of and meet their obligations under IR35.

Begin to prepare for the changes

Again, that depends on your perspective:

End user in the private sector – check to see if the small business exemption applies to you

Small end users – no change for you, so sit back and relax

Medium/large end users:

-

- review your current workforce and use of PSCs

-

- review any contracts that will extend beyond 6 April 2020 and determine if these IR35 changes will apply to them and, if necessary, introduce updated contracts that meet the need of the organisation.

-

- review and/or establish processes and procedures to ensure that a status determination is completed before engaging with a worker via a PSC. The need to train and support the relevant staff involved in this process going forward should also be considered.

- communicate the changes to your workforce and ensure that the contractors you work with are fully aware of how the changes will affect them.

Contractor

-

- review your current client base to determine if they will be exempt from these changes

-

- talk to any medium/large end user clients to determine how they believe these changes will affect you. There has been a shift from some large organisations insisting you work through your own PSC to some now imposing a blanket ban on contractors working through a PSC; the contractors having been given the option of becoming an employee or not working for the organisation.

- it may be that your PSC is no longer required and so, it may become necessary to consider winding-up the business.

These changes to the IR35 rules will have a significant impact on businesses and it is important for you to understand how the changes affect you. However, it should be noted that the government announced a review of the Off-Payroll Tax on 7 January 2020. Whilst this will not delay the implementation of the above changes it could mean more changes lie ahead.

If you would like to speak to someone about how this changes affect you or to make sure that your business is operating within the new requirements, contact our team today to chat with an advisor.